- Crypto wallet app

- Buy polka dot crypto

- Cryptocom cards

- Cryptocurrency bitcoin price

- How do you buy cryptocurrency

- Crypto com wikipedia

- Should i buy bitcoins now

- Bitcoin historical price

- Elon coin on cryptocom

- Ethereum crypto

- Current eth gas price

- Top 20 cryptocurrency

- Can you buy ada on cryptocom

- Metaverse crypto

- Ether 1 crypto

- How to transfer crypto from binance to binance us

- Cryptocom card

- What the hell is bitcoin

- What is gyen crypto

- How to close crypto com account

- Litecoin vs ethereum

- Lightcoin price usd

- Newest cryptocurrency on coinbase

- How does bitcoin make money

- Crypto merchant

- Will dogecoin be on coinbase

- Free btc club

- Bitcoin genesis block date

- Bonfire crypto price

- How to transfer money from cryptocom to bank account

- Dogecoin price usd

- Cryptocom unsupported currency

- Cryptocom verification process

- Cryptocom sell to fiat wallet

- Shibusd crypto

- How many btc are there

- Top 50 cryptocurrencies

- Bitcoin apps

- Bitcoin cryptocurrency

- Clover finance crypto

- Crypto com nft

- Btc mining

- Emax crypto

- Bitcoin misguided fear money creation

- How much is 1eth

- Bit coin diamond

- Bitcoin america from cancel culture

- Ass crypto price

- Crypto earn

- Cryptocom portfolio

- Send bitcoin

- How much to buy dogecoin

- Eternal crypto

- Google bitcoin

- Where to buy ethereum max

- Why buy bitcoin

- Create cryptocurrency

- Bitcoin one percent controls all circulating

- Cryptocurrency categories

- How to buy on cryptocom

- Surge crypto

- Hex crypto price

Dollars per ethereum

When it comes to understanding the value of Ethereum in terms of dollars, it is important to stay informed and up-to-date on the latest news and developments in the cryptocurrency market. The following list of articles will provide valuable insights and analysis on the topic of "Dollars per Ethereum," helping readers make informed decisions and navigate the ever-changing world of digital currencies.

Analyzing the Factors Influencing Ethereum's Price in USD

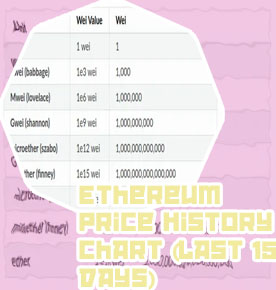

Ethereum has emerged as one of the leading cryptocurrencies in the market, with its price in USD being a key indicator of its performance. Various factors influence the price of Ethereum, making it a complex asset to analyze.

One of the primary factors influencing Ethereum's price is market demand. As more investors and traders show interest in Ethereum, its price tends to increase due to higher demand. This is evident in the recent surge in Ethereum's price, driven by increased interest from institutional investors and retail traders alike.

Another important factor is technological developments within the Ethereum network. The implementation of upgrades such as Ethereum 2.0 has a positive impact on the price of Ethereum, as it enhances the network's scalability and security. These improvements make Ethereum a more attractive investment option, leading to a rise in its price.

External factors such as regulatory developments and macroeconomic trends also play a significant role in influencing Ethereum's price. For example, regulatory crackdowns on cryptocurrencies in certain countries can lead to a decrease in Ethereum's price, as it affects market sentiment and investor confidence.

In conclusion, analyzing the factors influencing Ethereum's price in USD is crucial for investors and traders looking to make informed decisions in the cryptocurrency market. By understanding the various factors at play, individuals can better predict Ethereum's price movements

The Impact of Market Trends on Ethereum's Dollar Value

In recent months, the world of cryptocurrency has been closely watching the fluctuations in Ethereum's dollar value, as market trends continue to play a significant role in determining its price. The impact of these trends on Ethereum's value cannot be understated, as they have the power to either propel the cryptocurrency to new heights or cause it to plummet to new lows.

One of the key market trends that have been influencing Ethereum's dollar value is the rise of decentralized finance, or DeFi. The growing popularity of DeFi platforms has led to an increased demand for Ethereum, as it is the primary currency used for transactions on these platforms. As a result, the value of Ethereum has seen a steady increase as more investors flock to DeFi projects.

On the flip side, regulatory crackdowns and market volatility have also had a negative impact on Ethereum's dollar value. Uncertainty surrounding the future of cryptocurrency regulations in various countries has caused many investors to tread cautiously, leading to fluctuations in Ethereum's price.

Overall, it is clear that market trends play a crucial role in determining Ethereum's dollar value. Investors and enthusiasts alike must stay informed and vigilant of these trends in order to make informed decisions about their investments in Ethereum.

Strategies for Maximizing Profits in Ethereum Trading

Ethereum trading has become increasingly popular in recent years, with many investors looking to capitalize on the volatility of this cryptocurrency. However, in order to maximize profits in Ethereum trading, it is essential to employ effective strategies that can help minimize risks and increase potential returns.

One key strategy for maximizing profits in Ethereum trading is to diversify your portfolio. By spreading your investments across different assets, you can reduce the impact of volatility on any single asset and increase your chances of making a profit. Additionally, it is important to stay informed about market trends and news that could affect the price of Ethereum. By staying up-to-date on the latest developments, you can make more informed decisions about when to buy or sell.

Another important strategy for maximizing profits in Ethereum trading is to set realistic goals and stick to them. It can be tempting to chase after quick profits, but this can often lead to losses in the long run. Instead, set realistic targets for your trades and stick to them, even if it means missing out on some potential gains.

In conclusion, by employing effective strategies such as diversifying your portfolio, staying informed about market trends, and setting realistic goals, you can maximize your profits in Ethereum trading. By following these tips, you can increase your chances of success in this exciting and