- Crypto wallet app

- Buy polka dot crypto

- Cryptocom cards

- Cryptocurrency bitcoin price

- How do you buy cryptocurrency

- Crypto com wikipedia

- Should i buy bitcoins now

- Bitcoin historical price

- Elon coin on cryptocom

- Ethereum crypto

- Current eth gas price

- Top 20 cryptocurrency

- Can you buy ada on cryptocom

- Metaverse crypto

- Ether 1 crypto

- How to transfer crypto from binance to binance us

- Cryptocom card

- What the hell is bitcoin

- What is gyen crypto

- How to close crypto com account

- Litecoin vs ethereum

- Lightcoin price usd

- Newest cryptocurrency on coinbase

- How does bitcoin make money

- Crypto merchant

- Will dogecoin be on coinbase

- Free btc club

- Bitcoin genesis block date

- Bonfire crypto price

- How to transfer money from cryptocom to bank account

- Dogecoin price usd

- Cryptocom unsupported currency

- Cryptocom verification process

- Cryptocom sell to fiat wallet

- Shibusd crypto

- How many btc are there

- Top 50 cryptocurrencies

- Bitcoin apps

- Bitcoin cryptocurrency

- Clover finance crypto

- Crypto com nft

- Btc mining

- Emax crypto

- Bitcoin misguided fear money creation

- How much is 1eth

- Bit coin diamond

- Bitcoin america from cancel culture

- Ass crypto price

- Crypto earn

- Cryptocom portfolio

- Send bitcoin

- How much to buy dogecoin

- Eternal crypto

- Google bitcoin

- Where to buy ethereum max

- Why buy bitcoin

- Create cryptocurrency

- Bitcoin one percent controls all circulating

- Cryptocurrency categories

- How to buy on cryptocom

- Surge crypto

- Hex crypto price

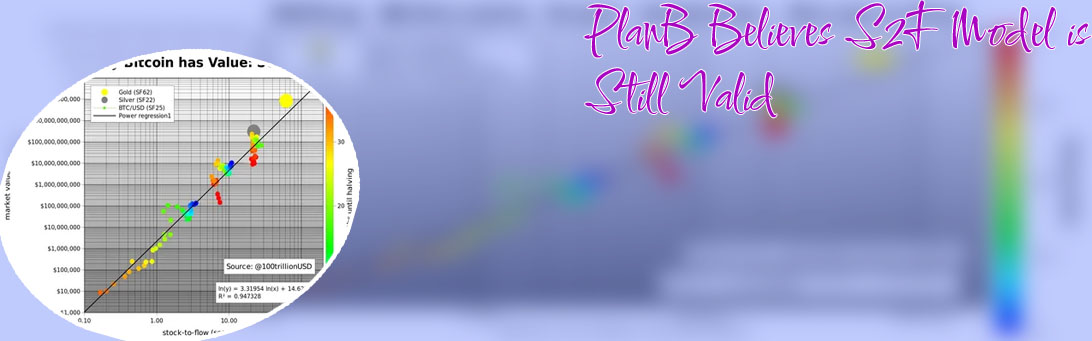

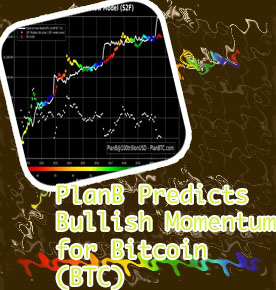

Plan b bitcoin prediction 2022

As we look ahead to the year 2022, many investors and analysts are eager to predict the future of Bitcoin and its potential price movements. In this article, we have curated a list of two insightful articles that delve into the topic of Bitcoin predictions for 2022. These articles provide valuable insights and analysis to help investors make informed decisions about their Bitcoin investments in the upcoming year.

These articles provide valuable insights and analysis to help investors make informed decisions about their Bitcoin investments in the upcoming year.

none

Expert Analysis: Bitcoin Price Prediction for 2022

As we move further into 2022, the world of cryptocurrency continues to be a hot topic of discussion among investors and enthusiasts alike. With the volatile nature of Bitcoin prices, many are eager to gain insights into what the future may hold for the leading digital asset.

Experts in the field have been closely monitoring various factors that may influence Bitcoin's price trajectory in the coming months. One key consideration is the ongoing regulatory developments around the globe, as governments seek to establish frameworks for the use and trading of cryptocurrencies. Additionally, macroeconomic trends, such as inflation rates and geopolitical events, can also impact Bitcoin prices.

Looking ahead, some analysts predict that Bitcoin could see significant price fluctuations throughout the year, with the potential for both bullish and bearish trends. Factors such as increased institutional adoption, technological advancements, and market sentiment will likely play a crucial role in shaping Bitcoin's price movements.

For investors and traders in the cryptocurrency space, staying informed about the latest developments and expert analyses is essential for making informed decisions. By keeping a close eye on market trends and expert predictions, individuals can better navigate the volatile world of Bitcoin trading and potentially capitalize on emerging opportunities.

The Factors Influencing Bitcoin's Price in 2022

Bitcoin's price in 2022 is influenced by a variety of factors that play a crucial role in determining its value. One of the key factors impacting the price of Bitcoin is market demand. The higher the demand for Bitcoin, the higher its price will be. Factors such as increased adoption by mainstream institutions, regulatory developments, and macroeconomic trends can all contribute to increased demand for Bitcoin.

Another important factor influencing Bitcoin's price is supply dynamics. Bitcoin has a fixed supply cap of 21 million coins, which means that its supply is limited. As a result, factors such as the rate of new Bitcoin production through mining, the activities of large holders (whales), and the rate of Bitcoin being taken out of circulation can all impact the overall supply of Bitcoin in the market, thereby influencing its price.

Additionally, market sentiment and investor psychology can also have a significant impact on Bitcoin's price. Positive news and developments in the cryptocurrency space can boost investor confidence and drive up the price of Bitcoin, while negative news can have the opposite effect.

In order to better understand and predict Bitcoin's price movements in 2022, it is important to consider factors such as market demand, supply dynamics, and investor sentiment. Keeping an eye on regulatory developments, institutional adoption, and macroeconomic trends can